SBI RTGS/NEFT Application Form :- It takes a lot of time to transfer funds by check. But at present, everyone can transfer funds in very little time by RTGS or NEFT system. Both these systems are the fastest service for transferring funds from one bank to another. Fund transfer can be done both online and offline in RTGS / NEFT system.

If you transfer money online using RTGS and NEFT systems, you will not have to pay any transaction fees on it. To promote digitization in India, the RBI stopped charging fees on online fund transactions through RTGS / NEFT. Whereas if someone transfers funds via RTGS / NEFT in an offline way, then the transaction charge will have to be paid.

Contents

What is RTGS?

The full form of RTGS is Real Time Gross Settlement. RTGS is an electronic payment system in which payment processing is done on real-time between two banks. In the RTGS system, there is a facility to send a minimum amount of 2 lakhs or more in real-time.

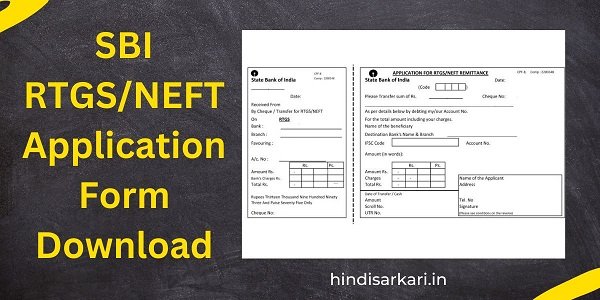

Therefore, any SBI Bank customer who wants to transfer money offline will have to fill the RTGS SBI application form and submit it to the bank.

What is NEFT?

The full form of NEFT is National Electronic Fund transfer. NEFT is an electronic method of fund transfer based on deferred net settlement (DNS), in which the amount is deposited in hourly batches along with other payments for all requests received in 30 minutes.

There is no minimum or maximum limit for transferring money through NEFT. Therefore, you can send any amount through NEFT.

Download Application Form For SBI RTGS NEFT Form

| Subject | SBI Bank RTGS / NEFT Form Download |

| Fund Transfer | Through RTGS / NEFT system |

| Method of transfer | Fund transfer through online & offline way |

| Beneficiary | SBI Customers |

| Purpose | Transfer money in a short time |

| Official website | State Bank of India |

Required fee & charges for fund transfer through RTGS/NEFT system

1.For Online transactions:- According to the RBI, to encourage digitalization, no charge will be levied on online transactions. Therefore, the customer can safely transfer funds from one bank to another bank through mobile / net banking.

2. For Offline transactions:- If a customer goes to SBI banks and transfers the money through NEFT/RTGS system, the customer will have to pay a fee on every transaction.

| Fund Transfer | Charges for Offline Bank branch |

| Up to 10,000 INR | 2.50 Rupee + GST |

| Between 10,000 to 1 Lakh INR | 5 Rupee + GST |

| Between 1 lakh to 2 Lakh INR | 15 Rupee + GST |

| Above 2 Lakh | 25 Rupee + GST |

| SBI fund transfer limit | No limit at Bank Branch |

Details required during SBI RTGS / NEFT form application

- Account holder name

- Bank branch details (IFSC code, Bank Name, Bank Location)

- Amount to be transfer

- Cheque Number

- Account Number

FAQ –

1. What is the difference between NEFT and RTGS transactions?

There is no minimum limit for fund transfer through NEFT which is based on deferred net settlement. Whereas the minimum amount of fund transfer under the RTGS system is Rs 2 lakh.

2. What is the NEFT limit per day?

Yes, 24×7 (365 days)

3. What is better NEFT or RTGS?

If you transfer funds above 2 lakhs, then RTGS is a fast and efficient service option. If less than 2 Lakhs and more than 5 Lakhs are transferred then NEFT is a good option.

4. How to download SBI RTGS/NEFT form in PDF?

You can download SBI RTGS/NEFT form from the given post.

5. Is RTGS and NEFT free?

If you transfer funds online, no charge will be levied. If you go to a bank branch and transfer funds offline, you will have to pay a charge for it.